You can be well prepared to sell your MSP at the highest valuation when the time is right by taking the appropriate action now.

The recurring revenue model of managed IT services offers unique benefits over traditional time and materials, hardware resale, and project-based business models. Delivering remotely provisioned and managed IT, cloud, and cybersecurity services dramatically reduces on-site service visits, and leveraging automated platforms to monitor and deliver these services significantly reduces costly labor and generates more profitable revenues over time. Additionally, the subscription-based nature of the MSP model, backed by long-term service agreements, helps insulate the business from economic downturns better than other reactive or project-based IT service delivery formats.

These factors and more make MSPs very attractive acquisition targets for potential buyers, as evidenced by the record level of M&A interest and activity.

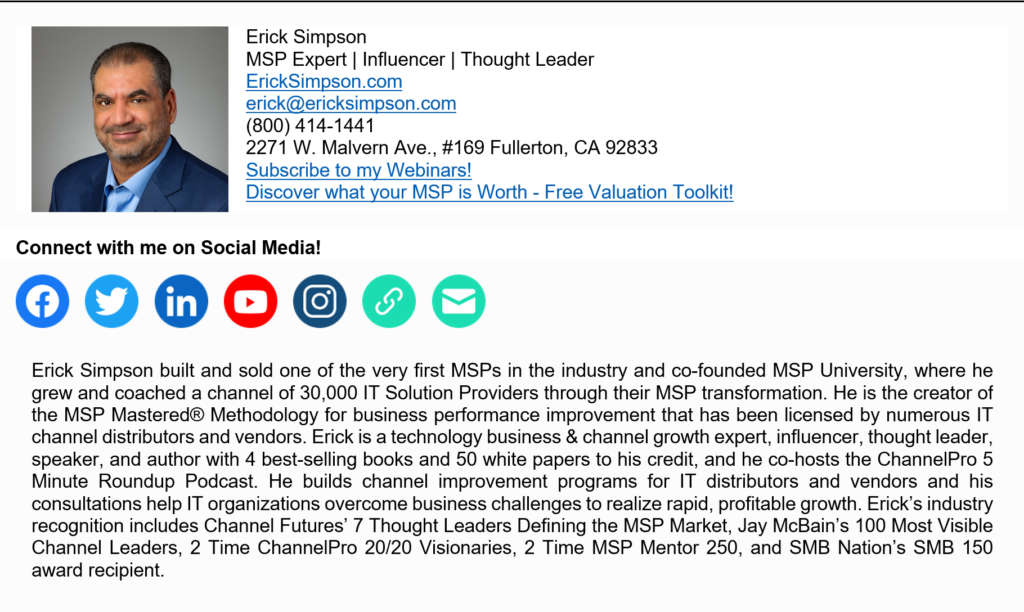

Since you’ve worked long and hard to build your MSP practice, it’s natural to want to understand its value and be clear on the reasons why you may choose to sell or exit the business. Your decision to sell can be based on many factors. For instance, your business may have reached its highest operational performance in history, encouraging you to engage potential buyers to negotiate the best offer and take advantage of today’s active MSP M&A climate. Maybe you’ve been receiving unsolicited inquiries to discuss your interest in selling your business, further inspiring you to act.

You may have a goal to fund your retirement with the proceeds of a sale. Or perhaps you’re simply ready for a change of pace or lifestyle and are ready to take some of your risks off the table. You might be interested to invest in or start another business venture, leveraging a portion of the sale proceeds to fund your next entrepreneurial journey.

And while these all sound like positive motivations to sell with high upside potential, there may be fewer positive reasons driving you to exit. These could include problems with a business partner or group of partners, or sudden and unexpected health concerns, or other personal or family issues. And finally, you may choose to sell and exit because you’ve taken the business as far as you are able, and feel if you wait too much longer, your ultimate valuation may suffer.

As an M&A adviser friend of mine likes to say, you should always run your business like you’re selling it – meaning at peak performance. In his opinion, too many sales result in low valuations due to a lack of strategic business preparation by the seller. In many cases, these sales have been made in response to unanticipated and less-than-favorable circumstances. The good news is that you can be well prepared to sell your MSP at the highest valuation when the time is right by taking the appropriate action now.

Many factors impact your overall business valuation, not the least of which is what your buyer is ultimately willing to pay for it. But their offer will also be influenced by a financial or strategic need.

If they are a financial buyer, then financial performance will be the lens through which they view your business. Purely financial buyers will lean heavily on valuing your company based on a multiple of your adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) performance. And if they are unfamiliar with recurring revenue business models like managed services, their valuation may skew lower than you may be willing to accept.

If they are a strategic buyer, in addition to financial performance, their offer will be influenced by the strategic value your business adds to their overall growth plan. A strategic buyer will value your organization slightly differently and potentially higher than a strictly financial buyer. In addition to adjusted EBITDA considerations, your business’s significance to their overall growth plan will impact the valuation. Favorable qualities may include your business serving a niche or target vertical or geography they find compelling; specializing in emerging technology or competencies that they are keen to acquire; or otherwise filling an important gap in their service or solution portfolio.

No matter who your potential buyer is, their ultimate offer will also take into consideration an assessment of your overall business operations, including your infrastructure and the consistency of your people, platforms, systems, and processes, along with your business qualities. It will encompass your products and services, the industries you serve, your geography, and your vertical market focus. Your growth trend in financial metrics, such as profit and sales, and the diversity and types of distinct revenue sources you enjoy will feature heavily in their evaluation, along with your percentage of overall revenue represented by recurring revenues and a solid cash flow. And potentially most important, buyers want to invest in a true business and not a job, meaning that the business must be able to run independently of you or them.

To attain the highest valuation, your business must rank well in the following areas:

- Consistent double-digit EBITDA performance with an upward year-over-year trend

- A solid, motivated management team and skilled, efficient staff with a strong company culture

- Mature financial systems and controls that can withstand a buyer’s due diligence and have a minimum of the last three years of certified financials on hand

- Buyer or seller involvement is not required at any level of day-to-day business operations

- Well-documented processes with highly integrated systems and platforms governing key operations such as finance, HR, marketing, sales, and technical service delivery

- Highly secure, scalable operational infrastructure

- Low staff and customer churn

- Consistency in the business in terms of controlled, sustainable, and steady revenue growth, skewing toward higher recurring revenues

- Diverse revenue sources comprising a mix of subscription- and project-based services, with a focus on emerging technologies, managed IT, cloud, and cybersecurity services

- Niche or vertical market business expertise and market share

- Solid, consistent cash flow with high on-time receivables collection and a low percentage of uncollected revenue

Building a highly profitable, growing business that commands the highest offer at exit isn’t easy – it’s like trying to eat an elephant. What’s the best way to do that? One bite at a time, with a strategy to know where you are, where you’re going, and how you’ll get there.

So where do you begin? To sell your MSP at the highest value you must first understand what it’s worth today and be able to forecast the impact of different growth strategies to raise that value. I’ve created a simple MSP Valuation Toolkit that allows you to do just that, and you can get it free here: https://www.pricemymsp.com.

I’ve been involved in dozens of M&A transactions on both the buy and sell side of the engagement for MSPs and vendors. If you haven’t yet experienced an M&A transaction, I caution you against going it alone, even if you perceive it to be a very small transaction. Instead, I strongly encourage you to seek out the help you’ll need to make the valuation, due diligence, offer, sale, and post-sale integration processes successful and avoid any costly mistakes along the way. Don’t hesitate to reach out to me to explore how I can help at: https://ericksimpson.com/contact.